Health Insurers Propose Significant Premium Hikes for 2026 ACA Plans

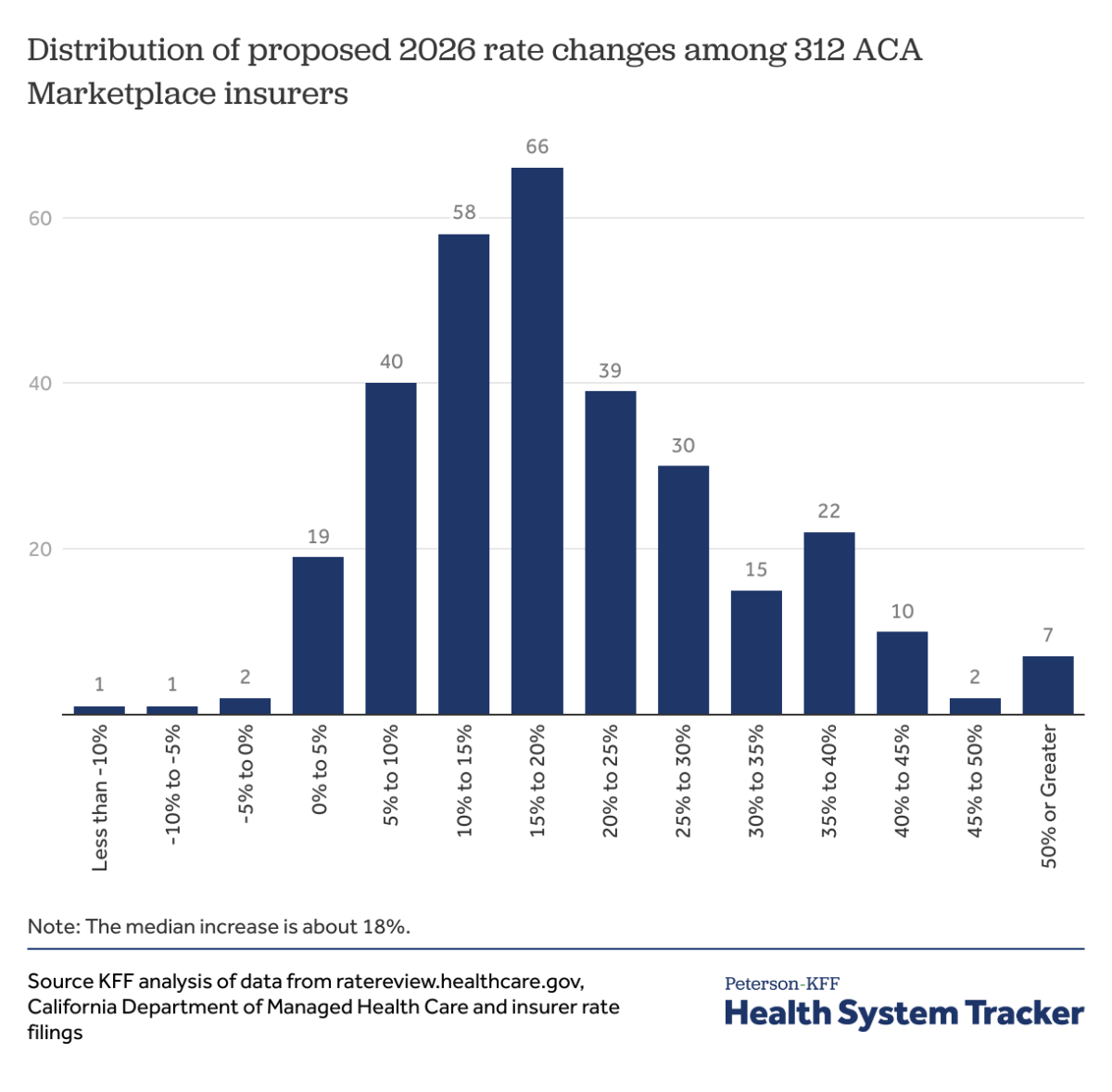

Health insurers participating in the Affordable Care Act (ACA) marketplaces have submitted their annual rate filings to state regulators, revealing a sharp increase in proposed premiums for 2026. These filings, which provide detailed insights into insurers’ expectations for the coming year, indicate a median premium increase of 18% across 312 insurers from all 50 states and the District of Columbia. This marks the largest requested hike since 2018, when policy uncertainties similarly drove steep premium rises.

Record-High Premium Increase Requests

The median proposed premium increase of 18% for 2026 is approximately 11 percentage points higher than the previous year’s filings. On average, insurers are seeking to raise premiums by about 20%, signaling a significant upward trend in health insurance costs within the ACA marketplaces. This surge reflects growing financial pressures on insurers as they anticipate rising healthcare expenses and other economic factors.

Key Drivers Behind Rising Premiums

Analysis of detailed filings from insurers in 19 states and the District of Columbia highlights several primary contributors to the premium increases. Foremost among these is the growth in healthcare prices, particularly the rising costs and utilization of high-priced prescription drugs. Additionally, insurers point to broader market dynamics such as increasing labor costs and persistent inflation as major factors pushing premiums upward.

These cost pressures are compounded by the ongoing challenges in the healthcare sector, including the demand for more complex treatments and services, which further strain insurer budgets and necessitate higher premiums to maintain coverage levels.

Impact of Potential Expiration of Enhanced Premium Tax Credits

Another significant consideration influencing insurers’ rate proposals is the potential expiration of enhanced premium tax credits. These credits have played a crucial role in making ACA plans more affordable for many enrollees by subsidizing premiums. Insurers are factoring in the possibility that these enhanced credits may not be extended, which would reduce financial assistance for consumers and likely lead to higher out-of-pocket costs.

The anticipated expiration of these subsidies is prompting insurers to adjust their premium rates upward to offset the expected reduction in government support, further contributing to the overall increase in premiums for 2026.

Broader Implications for ACA Enrollees

The proposed premium hikes come at a time when a growing, yet still relatively small, segment of the population relies on ACA marketplace plans compared to employer-sponsored insurance. The availability of enhanced premium tax credits has been a key factor driving enrollment growth in these individual market plans.

However, with premiums set to rise sharply and uncertainty surrounding the continuation of subsidies, many consumers may face increased financial burdens. This could impact enrollment decisions and access to affordable coverage, underscoring the importance of policy decisions related to premium tax credits and healthcare cost containment.

Conclusion

For 2026, ACA marketplace insurers are signaling a notable shift with premium increases not seen since 2018. Rising healthcare costs, particularly for expensive medications and labor, combined with inflation and the uncertain future of enhanced premium tax credits, are driving these proposed hikes. As regulators review these filings, the implications for consumers and the broader health insurance market will be closely watched.