Social Security to End Paper Checks by September 30

The Social Security Administration (SSA) announced a significant shift in its payment system, set to phase out paper Social Security checks starting September 30. This move aligns with broader federal efforts to modernize payment methods and enhance efficiency.

Faster, Safer Payments Through Electronic Transfers

According to the SSA, electronic funds transfers (EFTs) deliver payments to beneficiaries more quickly than traditional paper checks. Beyond speed, EFTs offer increased security against fraud and generate substantial cost savings for the federal government. While issuing a paper check costs roughly 50 cents each, EFTs reduce this expense to less than 15 cents per transaction.

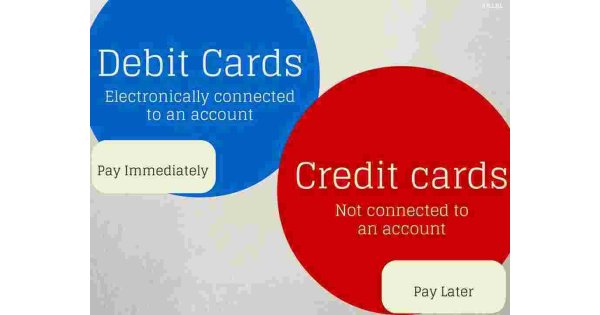

The agency is encouraging beneficiaries to switch to direct deposit or to use the Direct Express prepaid debit card, a federal benefit payment card designed to facilitate electronic payments. Despite the push for electronic payments, the SSA will continue to issue paper checks in limited cases where no other payment method is feasible.

Majority Already Transitioned, SSA Targets Remaining Paper Check Recipients

Most Social Security recipients have already moved away from paper checks. The SSA reports that fewer than one percent of beneficiaries still receive paper checks. To ensure a smooth transition, the agency is proactively contacting those individuals to inform them about the upcoming changes and guide them through enrolling in direct deposit or obtaining a Direct Express card.

"Where a beneficiary has no other means to receive payment, we will continue to issue paper checks," a Social Security spokesperson told FOX Business.

Comprehensive Outreach to Beneficiaries

In addition to direct communication, the SSA plans to include informational inserts with all benefit checks. These inserts will explain how recipients can switch to electronic payments, providing clear instructions to facilitate the transition.

This modernization effort reflects a broader federal initiative to improve payment systems by leveraging technology, reducing costs, and enhancing security for millions of Americans relying on Social Security benefits.