The sharp decline in auto production triggered a deepening downturn in German industry as production fell for the third consecutive month in July, intensifying pressure for the government to do more to pull the economy out of the bottleneck.

The monthly decline of 0.8 percent, reported by Germany's Statistical Office, exceeded economists' forecast for a 0.5 percent decline in a Reuters poll.

It would have been even bigger had there not been a recovery in energy and construction production in July.

Production in Germany's auto manufacturing sector fell by 9 percent.

Europe's largest economy has shrunk or stagnated over the past three quarters, and its recovery from the coronavirus outbreak has been slower than the United States or the overall eurozone, with higher energy prices, rising interest rates and a slowdown in trade with China, its second-largest export market.

Ralph Solveen, an economist at German lender Commerzbank, said the continued decline in industrial production has affected \all manufacturing groups\ and will continue to \contribute to the contraction of the German economy in the second half of the year.\ Adding to the gloom, the EU's statistics office cut its official forecast for eurozone growth in the second quarter to 0.1 percent from 0.3 percent.

The move follows declines in growth forecasts for Italy, Ireland and Austria and means the euro area lags further behind the United States, whose gross domestic product grew by 0.6 percent in the quarter.

The euro fell 0.2 percent to $1.0707 against the U.S. dollar on Thursday, approaching a three-month low.

Fears are growing that German industrial groups are shifting production abroad.

BASF, the country's leading chemical company, has chosen to build a new 10 billion-euro petrochemical plant in China and is downsizing its sprawling headquarters on the banks of the Rhine River in Ludwigshafen.

The German Chamber of Commerce and Industry recently found that 32 percent of companies surveyed prefer investments abroad over domestic expansion.

Carsten Brzeski, an economist at Dutch bank ING, who calculates that German industrial production is still 7 percent below pre-pandemic levels, said, \Germany's industrial production continues to turn its nose up and even die-hard pessimists are afraid.\ The government came under intense pressure to overcome the country's economic woes.

This week, Chancellor Olaf Scholz pledged to boost growth and eliminate the \mold of bureaucracy\ by accelerating digitalisation for online government services and e-invoices (areas where Germany lags behind) and making it easier for startups to set up and grow.

Scholz rejected the idea of a subsidized electricity price for energy-intensive companies or a large stimulus package to boost growth.

Last week, it unveiled plans for a €7 billion package of corporate tax cuts that include new rules on depreciation of investment costs for construction, digitalisation and green energy. \The positive news is that the sense of urgency has finally increased,\ Brzeski said.

Now let's wait for more concrete policy action.

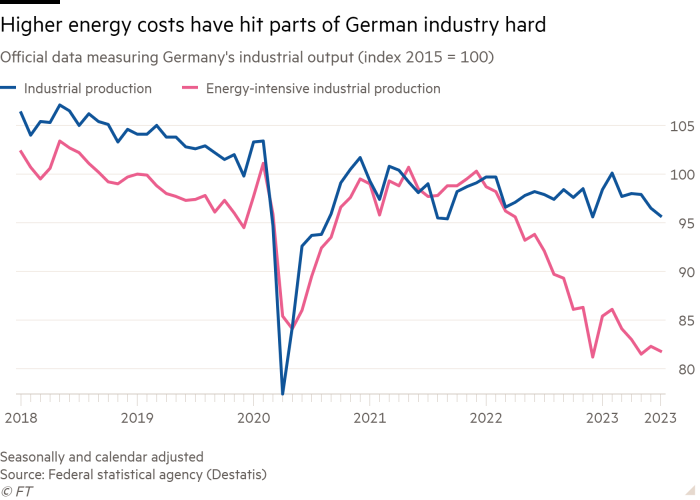

Until then, industrial stagnation and the broader economy seem to be the new normal.\\ Destatis, the federal statistical agency, said the annual decline in industrial production in July was 2.1 percent.

The most energy-intensive industries, such as chemicals, metals and glass, experienced a larger decline of 11.4 percent year-on-year.

German manufacturers are working on backlogged order lists, but they are shrinking.

New orders for German industry fell 10.7 percent in July from the previous month, the biggest drop since the first pandemic lockdown that closed many factories in April 2020.

Franziska Palmas, an advisor at Capital Economics, said: \While the backlog of unfilled orders is still high, it is falling steadily, so it is unlikely to support production for much longer.\ We expect production to fall further for the rest of the year, contributing to Germany's descent into recession.

Another factor holding back many German companies is labor shortages.

A survey of 9,000 companies in the country by the Ifo Institute last month found that 43.1 percent were experiencing a shortage of skilled workers, an increase from the previous month, but last year almost half of all companies fell from their all-time high.