High interest rates mean a boom for fixed-income investments, but taxes can be a buzz.

Savings tips: A rule to increase your savingsThis budgeting rule will help you boost your savings account.

Soaring interest rates have reignited Americans' passion for fixed-income investments like bonds and money market funds, but experts warn they need to be prepared for taxes.

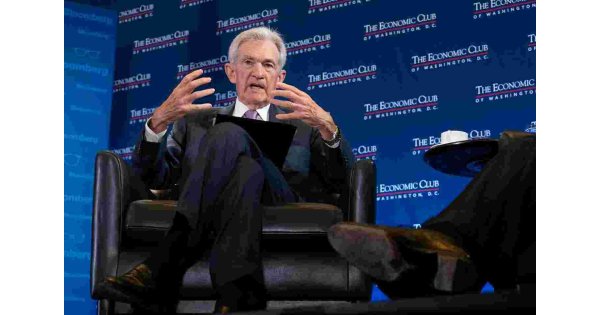

To combat inflation, the Federal Reserve raised its benchmark short-term fed funds rate to 5.25%-5.50%, close to zero at the beginning of 2022 and from its highest level in 22 years.

Higher rates hurt spenders who have to pay more to borrow, but they are a boon for savers who earn a higher return on their money, especially when the economy is uncertain and the stock market is volatile.

For example, according to Fed data, money market fund assets hit a record high of over $5.69 trillion in the first three months of this year.

That higher, stable, and nearly risk-free income may come at a price, experts say: By the new year, you may find yourself with a bigger tax bill. \On the one hand, that's great news, you're getting more attention, but if you need to make quarterly estimated payments, are you ready for a tax cut in April or sooner?\ says Rob Keller, tax partner at tax consulting firm KPMG.

What are fixed income investments?

Fixed-income assets are those that have a regular, fixed payment, such as savings accounts, money market funds, certificates of deposit (CDs), or state and municipal bonds.

They are usually low-risk income generators.

In a balanced portfolio, they are used to balance stock holdings, which are riskier and often yield returns by gaining value.

A traditional balanced portfolio, also known as a 60\/40 portfolio, consists of 60% stock and 40% fixed income.

How are fixed income investments taxed compared to stocks?

Money from fixed income assets is counted as income and is taxed at your income tax rate, no matter what bracket you fall into.

In 2023, the IRS lists seven federal income tax rates ranging from 10% to 37%. \These are typically higher than the dividends and capital gains from stocks,\ says Omar Qureshi, investment strategist at Hightower, a wealth advisor in St. Louis, Mo. Qualifying stock dividends and capital gains tax rates for assets held for at least one year range from 0% to 20%, depending on taxable income and filing status.

The IRS says most people pay a 15% capital gains tax when they sell their stock.

Fixed income payments may also be subject to government taxes.

This can be especially bad if you're in a state with a high income tax, such as California or New York, both of which have the highest rates above 10%, the consultants say. \If you're in a high tax bracket, about 50% of your interest income goes back to the government,\ Qureshi said.

On the surface, 5.5% interest on your money sounds good, but if you have to give half it back, it's not so good.

Yes, think about what you buy and where you hold assets.

If you invest in a U.S. government-backed security such as a T-banknote, note, or bond, you can avoid state tax.

You'll continue to pay federal taxes on interest income, but if you live in a high-tax state like California, a T-bill can be a great investment because you can save on the state side of the house,\ Keller said.

Municipal bonds issued by state, city and local governments are also generally exempt from federal taxes.

They are also usually exempt from state tax in the state where the bond is issued, but there are exceptions, so consultants tell them to step in carefully and talk to a consultant about the rules regarding municipal bonds you are considering.

Invest in fixed income assets through your non-taxable retirement accounts.

Not only will this allow you to skip taxes now, but you'll also want to check it out when you want to take the money and pay taxes, says JR Gondeck, managing director and partner at the Lerner Group asset management firm.

To avoid risk: The best low-risk investments of 2023Given the tax hit, are fixed-income investments worth it?

Advisors say that despite the tax blow, you're still likely to come out ahead, even if it's not as much as you expected. \Even if you're paying taxes, you're still making money,\ Keller said.

Also, it's good to charge 5.5% interest for many taxpayers.

Not every taxpayer pays the highest marginal (income tax) rate, and perhaps they live in a state like Texas that has no (income) tax. \\ What else should I know about fixed income investments?

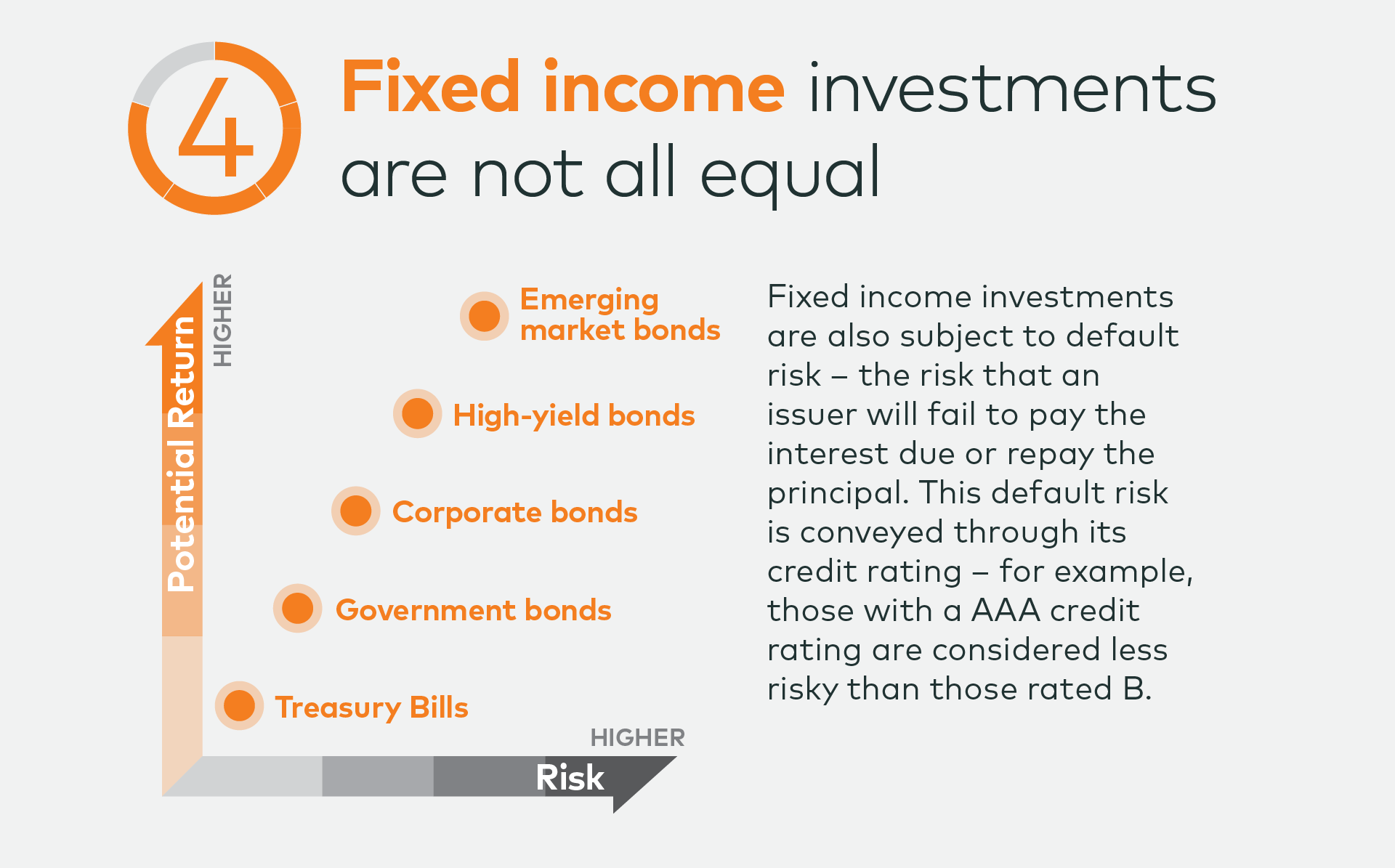

Not every fixed income asset is the same, so you need to do your homework.

For example: Treasuries are the safest because they are 100% guaranteed by Uncle Sam so you can always get your initial investment back, but money market funds are neither guaranteed nor FDIC insured, meaning you could lose your entire investment.

Money market accounts and CDs, though, are FDIC insured up to $250,000.

Municipal bonds are not as easy to sell as the Treasury, because if you want to unload them, because they are issued in much smaller quantities.

While CDs are easier to buy than Treasury — Treasuries must be purchased directly from the government, but CDs can be purchased from banks, credit unions, and brokerage firms — CDs require close management.

The speed at which you are locked for a CD is only for the duration of the CD.

If the CD rolls over automatically, it can do so at a slower speed.

Or if you cash in early, there may be fees.

There are no fees for cashing out a Treasury.